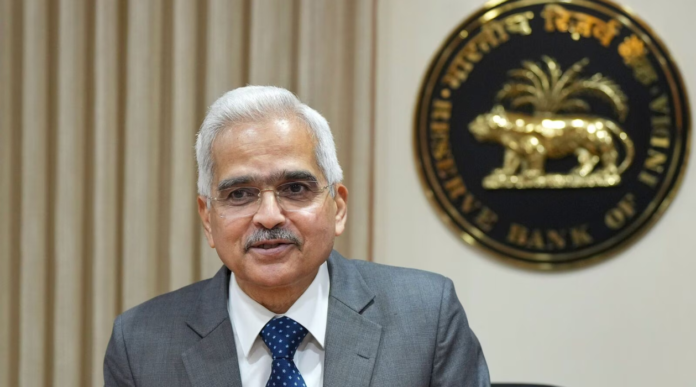

In light of the current international tensions and global economic challenges, the head of India’s central bank, Shaktikanta Das, made it clear on Friday that interest rates will continue to be on the higher side for now. However, he didn’t specify exactly how long this elevated level of interest rates will last.

Addressing the audience at the Kautilya Economic Conclave 2023 last Friday, the governor shared that, at present, we can expect interest rates to remain on the higher side. As for how long this trend will persist, well, that’s a question only time can answer.

During his address, Shaktikanta Das emphasized how complex the task of managing monetary policy has become and made it clear that there’s no room for taking things lightly.

Interestingly, major central banks worldwide have decided to increase their key policy rates in order to tackle the problem of rising prices. In India, we’ve seen a positive shift, with inflation starting to ease off significantly after reaching its highest point back in July of this year.

Similar to how other countries’ central banks make adjustments, the Reserve Bank of India increased its short-term lending rate (known as the repo rate) by a total of 2.5% starting from May 2022. However, in February of this year, the RBI decided to hold off on further increases and kept the repo rate at 6.5%.

During a gathering, Shaktikanta Das highlighted the importance of keeping the monetary policy focused on actively reducing inflation. This is to ensure that the decline in domestic inflation, which peaked at 7.44% in July, continues smoothly.