In our modern digital age, holding physical stock certificates might seem a bit old-fashioned. Most people have moved their paper certificates into digital form. You’ve probably heard someone ask a question like, “My dad gave me a folder with old share certificates.” These situations aren’t uncommon, and dealing with old paper stock certificates can be a hassle.

A stock certificate is basically a piece of paper that proves you own a part of a company. It’s like a legal proof that you’re a shareholder in that business. These certificates have important information on them, like your name, the number of shares you own, when you bought them, the type of stock, an identification number, and a stamp of approval from a company representative. They often have security features to prevent fraud, such as watermarks, raised printing, and holographic elements.

Old stock certificates can be valuable in two ways:

Financial Value: If the company is still in business, and its shares can be traded, your certificate may have monetary value. You can sell it to a broker or the company itself for cash.

- Collectible Value: Some old stock certificates are valuable to collectors, especially if they are from companies that no longer exist or have unique features.

Today, physical stock certificates are less common. Most companies keep track of ownership electronically. But some people still prefer having a physical certificate.

If you want to sell your old stock certificates, you have two main options:

- Through the Transfer Agent: This is a company that handles stock transfers for other companies. To sell your certificates this way, you need to contact the transfer agent and complete a transfer form. They will move your shares to your brokerage account for you to sell.

- Using a Broker: Another option is to sell your old certificates through a broker. You’ll need to open a brokerage account and deposit your certificates there. The broker will help you sell them.

Both methods have their pros and cons. Selling through the transfer agent is usually cheaper and they have good knowledge of the company’s stock, which makes the transfer smoother. However, it can take some time, and there may be fees.

Selling through a broker is quicker, and you have more flexibility to sell when you want, but it can be more expensive due to commissions.

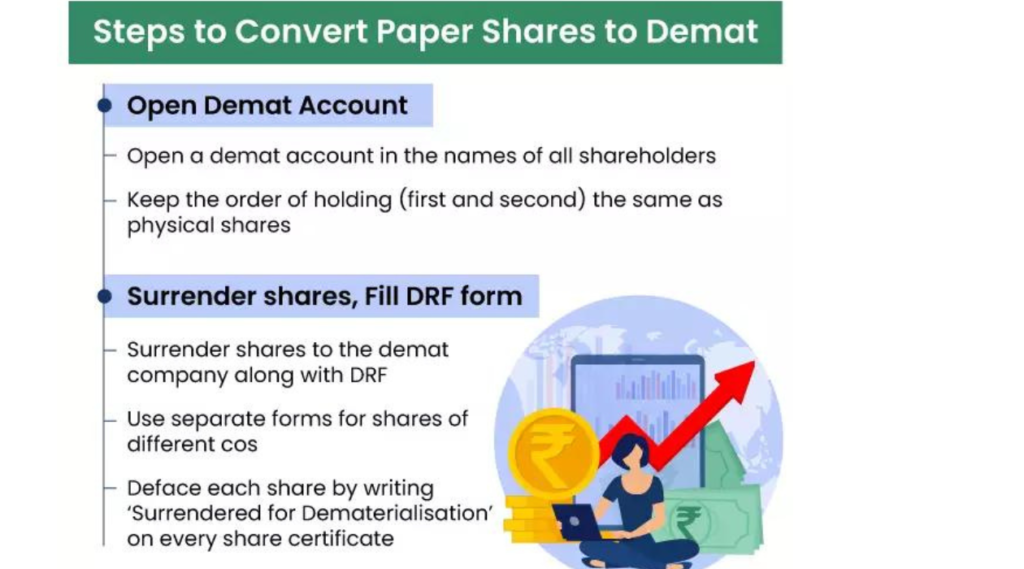

If you prefer not to keep physical certificates, you can convert them into electronic form through a process called “dematerialization.” This means transferring your paper certificates to a digital record with the help of a transfer agent. It’s a way to modernize your old certificates.